Liabilities typically represent quantities your small business owes or obligations it should fulfill. Accrued depreciation, nevertheless, isn’t a debt to be repaid – it’s the discount of an asset’s book worth over time (due to issues like wear and tear). Over time, corporations could have to revise their depreciation estimates because of adjustments within the asset’s situation, market factors, or technological developments. For instance, a machine that was initially expected to last 10 years could additionally be re-evaluated and found to have a helpful lifetime of only 8 years. When such changes occur, corporations must modify their depreciation schedules accordingly, making use of the brand new estimates prospectively. Asset impairment occurs when the carrying amount of an asset exceeds its recoverable amount.

The reversal of accrued depreciation following a sale of an asset removes it from the corporate’s stability sheet. In addition, companies may incorrectly estimate the helpful lifetime of an asset, resulting in incorrect depreciation expense amounts. To avoid this, corporations ought to conduct regular asset assessments to find out the accurate useful life of every asset. Units-of-production depreciation hyperlinks the expense to the precise usage or output of the asset. This method benefits manufacturing gear, the place the depreciation expense correlates with the variety of units produced.

Depreciation Expense

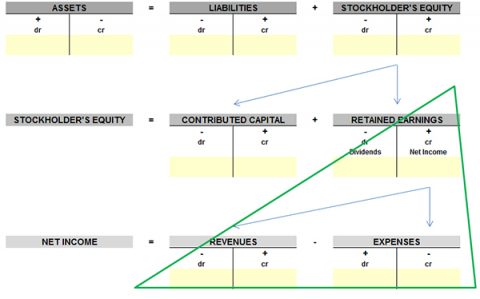

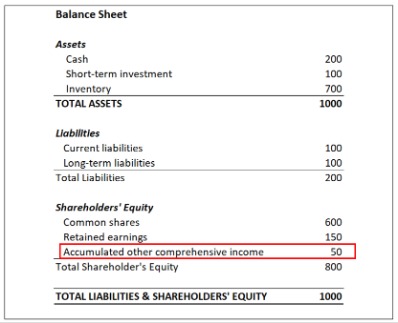

Greater depreciation expense contributes to greater complete bills, which outcomes in lower net revenue. Firms with mostly older belongings that have been totally depreciated and corporations with few long-lived property profit from low depreciation expense and better web earnings. The disparity between book depreciation and tax depreciation can lead to the institution of deferred tax liabilities or property. In the early years of an asset’s lifespan, a deferred tax legal responsibility arises when the company’s tax depreciation exceeds its book depreciation. Conversely, a deferred tax asset may happen if the company’s book depreciation exceeds its tax depreciation. Managing these deferred tax balances is essential for businesses to make sure they fulfill their tax obligations accurately and well timed over time.

By analyzing income statements with depreciation expense from varied companies, stakeholders can establish trends and patterns in depreciation expense reporting and evaluation. This can provide priceless insights into a company’s financial performance and inform funding selections. Additionally, Microsoft’s 2020 revenue statement stories depreciation and amortization expense of $2.5 billion, which is a vital portion of its total operating bills. By analyzing this expense, buyers can gain insight into Microsoft’s asset base and its impact on the company’s profitability and cash flow. By avoiding these frequent errors, firms can make sure that their earnings assertion with depreciation expense precisely displays their monetary efficiency.

As such, it’s crucial for financial managers to grasp the nuances of depreciation and its tax implications to make knowledgeable selections that align with their company’s long-term goals. To illustrate, consider an organization that purchases a supply truck for $50,000 with an expected life of 5 years and a salvage value of $5,000. Nevertheless, if the corporate opts for the double-declining balance method, the primary 12 months’s depreciation would be $20,000 (40% of $50,000), significantly impacting EBIT and web revenue.

Yes, but its impression extends beyond the income assertion, affecting how companies current their money move state of affairs. This implies that whereas it reduces net earnings https://www.simple-accounting.org/, it doesn’t contain an precise outflow of money during the interval. This distinction is important for understanding a company’s true cash circulate, which is addressed within the statement of cash flows. Analyzing its influence alongside other financial statement items provides a more full view of a company’s financial place and efficiency. The question of where does depreciation go on the revenue statement is crucial for understanding a company’s monetary performance.

Cost profitability is a measure of how well a enterprise can generate income from its prices. Tax professionals could view depreciation as a tax deduction opportunity, influencing an organization’s tax liability. The info provided on this web site does not, and is not meant to, constitute legal, tax or accounting recommendation or recommendations.

Why Is Amassed Depreciation A Credit Score Balance?

- Depreciation is a important accounting concept that allocates the price of tangible property over their useful lives.

- Nonetheless, its implications lengthen far beyond the immediate accounting interval and can have a profound influence on business valuation over the lengthy run.

- As we look ahead, it is clear that the companies that adapt to those adjustments swiftly and effectively shall be better positioned to manage their assets in a way that optimizes their monetary efficiency.

- Every recording of depreciation expense will increase the depreciation cost steadiness and decreases the worth of the asset.

- This exploration of depreciation’s place within financial statements is important for knowledgeable decision-making.

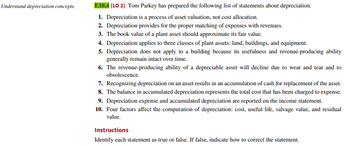

Every method has its distinctive method to allocating the value of an asset over its useful life. Depreciation happens through an accounting adjusting entry during which the account Depreciation Expense is debited and the contra asset account Accrued Depreciation is credited. Incorporating tax depreciation includes updating the depreciation schedule to mirror the tax-related changes while complying with the necessities of tax authorities. There are various methods to calculate depreciation, with each methodology having its personal formulation. The most typical methods are Straight-Line Depreciation, Accelerated Depreciation, and Units of Production Depreciation. The depreciable base is the difference between the worth of an asset and its estimated salvage worth.

The effective recording of where does depreciation go on the revenue assertion helps in providing an correct financial overview. Asset turnover ratios, such because the mounted asset turnover ratio (Revenue / Average Internet Fixed Assets), are also affected by depreciation. Higher amassed depreciation leads to a decrease net mounted asset worth, which in flip increases the fixed asset turnover ratio. A larger ratio means that the corporate is efficiently utilizing its fixed belongings to generate revenue. Adjustments in depreciation strategies or policies can significantly impact this ratio, making it essential to understand a company’s accounting choices when comparing its performance to rivals. Also understanding where does depreciation go on the income assertion helps with getting the whole image.

Understanding the place depreciation expense is reported is significant in assessing the influence of these methods. As businesses proceed to evolve in a rapidly altering economic landscape, the methods surrounding depreciation and asset administration are also undergoing significant transformation. This shift is pushed by the need for extra precise financial reporting and the need to optimize tax advantages, which immediately impression cash move and net earnings. By doing so, they’ll gain a deeper understanding of a company’s profitability and cash move, making knowledgeable decisions about its future prospects. Depreciation is a non-cash accounting methodology that allocates the value of a tangible asset over its useful life.

Is Depreciation A Positive Money Flow?

In conclusion, understanding the tax issues for depreciation performs a vital function in managing a company’s monetary health. By correctly accounting for depreciation expenses and profiting from tax deductions, businesses can optimize their money circulate and enhance their overall monetary efficiency. Depreciation is a non-cash accounting method that reduces the worth of an asset over time. While it doesn’t directly affect cash circulate, it has significant tax implications that can affect an organization’s financial technique and web revenue. From a tax perspective, depreciation serves as an expense that reduces taxable revenue, thereby potentially decreasing the tax legal responsibility for a business. This accounting apply is recognized by tax authorities and is ruled by particular rules that dictate the method and price of depreciation that can be utilized.